When you're good saved for your world trip, Yippee have a plan ready and actually going on a trip, it is wise to think carefully about your money matters and what you do in case of an emergency. Whether you are going on a short holiday, making a long journey or actually traveling around the world for a year, it is always smart to backup to have. After all, you never know whether your debit cards, bank accounts and credit cards will be the end of your life world trip go get it.

Also read: Saving for a World Trip | Step-by-step plan, goals and tips

Have a budget backup plan

Splitting your money into different accounts that are not easily accessible via a card prevents potential budget problems along the way. You may need to open other account(s) for this, but do it! From there you can transfer smaller amounts during your world trip to an account with card access. So if your card is stolen or skimmed, the thieves will only have access to a quantifiable amount.

Also read: Staying calm and positive during your World Trip | 6 Tips

Because of the difficulties in getting new cards along the way, it's also a good idea to have more than one account that you keep pretty much empty but can transfer money into if needed.

While traveling, keep most of your money in a bank account that cannot be accessed by card, but can be accessed online.

Wereldreizigers.nl

Suspicious transactions abroad

After all, you never know when a bank decides to lock your account for suspicious activity without telling you. This happened to me recently in Jordan - the bank did not trust the sudden transactions there and blocked my account.

Fortunately, I also had my BUNQ travel card with me, so I was able to transfer some money quickly via my internet banking app and, oh well, I was still able to get money from the same machine within 5 minutes. Dissolved!

Robbery, theft, loss or skimming

In addition to a blockage due to suspicious behavior, everything can happen as a result of which you can suddenly no longer use an account and it pays to be prepared for this. Provide extra passes and/or bills! You won't be the first so lose his or her debit and credit cards for whatever reason. Always make sure you have a backup in case of loss – both physical cards and online accounts that you can always access online. Spread your steps in your luggage, put 1 deep in your backpack or in your partner's backpack, or in the pocket of a pair of pants that you barely put on. Minimize the chance that you can't do anything with your money in one fell swoop.

Eligible Bank Accounts and Credit Cards

The only question now is, which banks or accounts will you use? Are you satisfied with your current bank and the opportunities it offers abroad? Before departure, look carefully at the costs for debit cards and the use of your card credit. You can save a lot of money by researching this beforehand. For example, do you pay per transaction or a percentage of the total amount?

Dutch debit cards also usually work with Maestro, but this is by no means accepted everywhere. You can locate any ATM that accepts it on the Maestro website. In some countries it is better to have a Mastercard or VISA card because these are more widely accepted.

Also check the validity of your debit card and credit card so that you do not suddenly end up without a card. In addition, you have to set your debit card to 'worldwide use' these days, because otherwise you can't use it outside of Europe. You can do this in your bank's app or via internet banking.

BUNQ Travel card

BUNQ bank now has the 'Travel Card – (here request for free)', a disguised 'credit card' account that you can create with the App. It is a debit card in combination with an online account but with all the rights and possibilities you would expect from a credit card. That is to say: it is an account in your App to which you can deposit money with iDeal, but which you can use anywhere in the world as a credit card. Even for car rental!

Also read: Which (prepaid) credit card is best to travel with? And why?

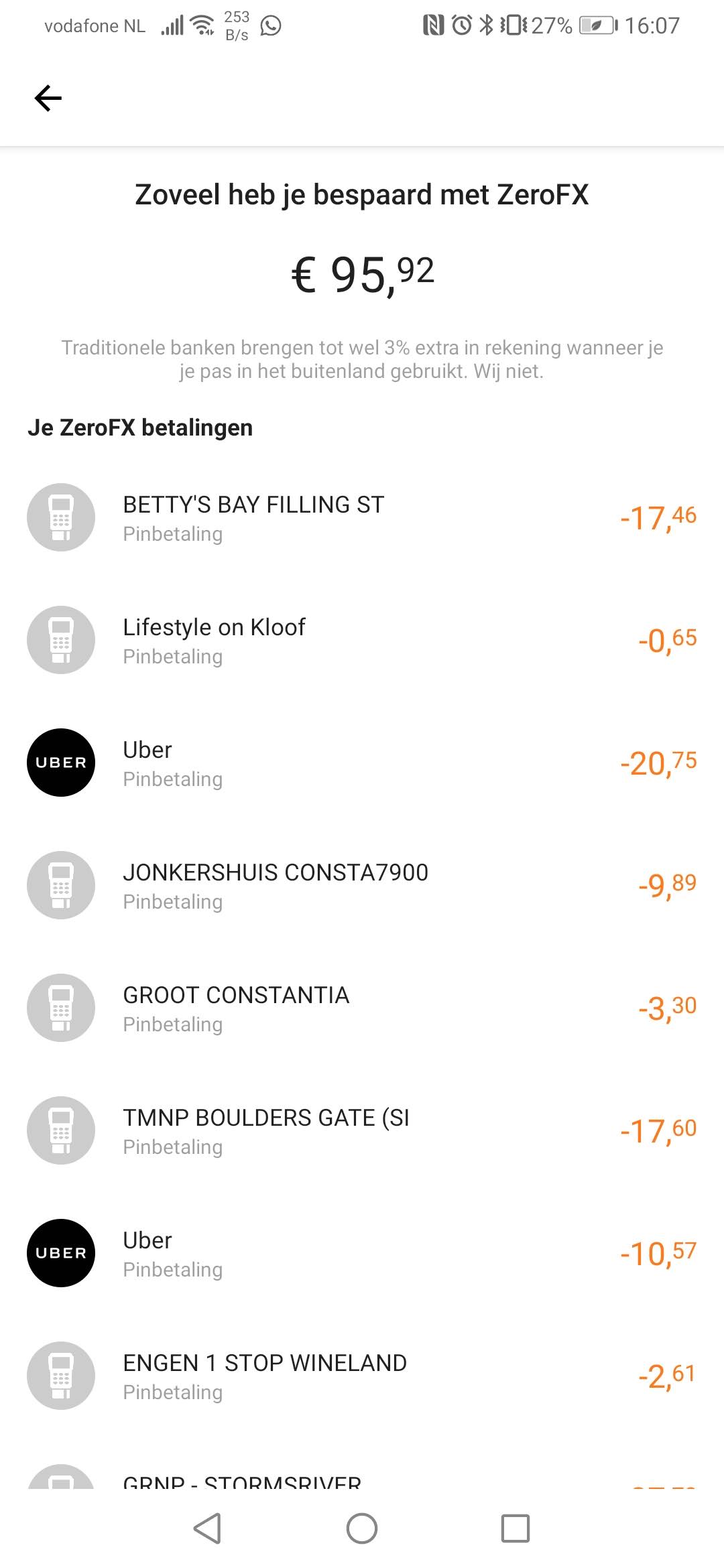

The Travel Card costs 10 euros once and is therefore also one of the cheapest 'credit cards' available. Also, with the BUNQ Travel Card you don't pay any currency conversion fees (they call it ZeroFX) with every payment – I've tested the card extensively and compared it with other credit cards during my travels and I can assure you, this will last you in the long run really save money. Super handy to use (also via your phone without a physical map) during your world trip, but also just to have with you as a backup.

The only drawback of the Travel Card is that you actually have to put all the money you want to spend on the card first, so you can't take a 'credit' to pay back afterwards. However, anyone from outside can simply deposit money into your Travel Card, so that you can still be helped by family or friends in the event of an emergency.

ANWB Credit Cards

Another good credit card for your world trip are the various ANWB credit cards. Like the BUNQ Travel Card, they are accepted worldwide and you get a lot of extras, such as purchase insurance, high limits and even the option for emergency money if you get into trouble. They are good options for your world trip, but also an expensive one. You not only pay the annual fee, the costs per transaction are also a lot higher than those of BUNQ.

Airline credit cards

Then there are the so-called credit card of airlines. The competition there is fierce and the differences are huge, so to really dig deeper into that, we'll be dedicating another blog to that shortly.

It is good to know that they exist, especially if you plan to fly with the same airline more often during your world trip. You often save at the same time for points (kind of air miles), discounts or free upgrades, meals or airport lounges. It can therefore certainly be worthwhile to purchase such a credit card, but it really depends on your plans and wishes.

Also read: Vaccinations for a World Trip | Everything you need to know

Also read: Which travel insurance do you need for a trip around the world?